Competitive intensity across the service provider landscape has increased significantly over the past few years. While most pronounced in the large tier 1 service provider segment, the level of competition has recently picked up in the midsize and small communication service provider market. The competitive landscape now includes a broader set of providers such as the following:

◉ Cable providers broadening their portfolio of services beyond traditional video services and expanding into new areas like wireless

◉ Gaming companies offering their content as a service in conjunction with cloud and/or connectivity providers

◉ Electrical cooperatives emerging as the latest new entrants to the communications market as they look to diversify their business and bring broadband access solutions to rural areas

◉ Cloud providers playing an increasing role in hosting small-medium business workloads

To maintain competitiveness, midsize/small service providers must innovate at the service level and focus on key customer segments where they can provide differentiated value. This innovation will include improving the service enablement process to drive efficiencies and accelerating the time to market for new service offerings.

Improving the Service Enablement Process

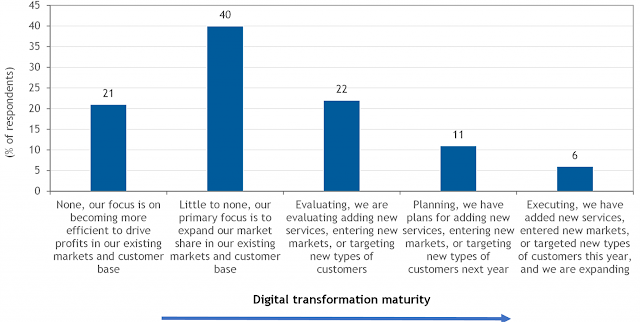

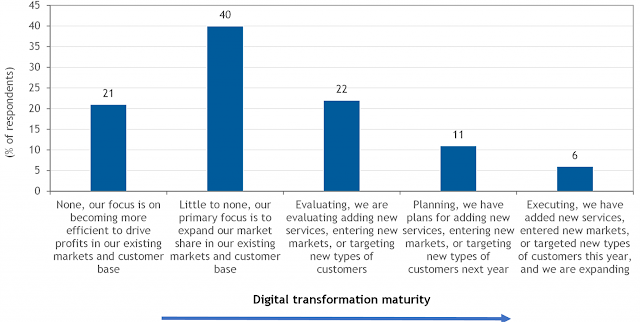

Most midsize/small service providers interviewed as part of IDC’s SP Digital Readiness Survey are primarily focused on expanding their existing set of services to new customers and broadening their partner channel; these providers see such initiatives as key to expanding their customer base. However, over time, these providers will increasingly look to develop compelling new service offerings to customers. In fact, nearly 40% of midsize/small service providers indicated that the rollout of new services is an essential component of their growth strategy. These providers are either evaluating, planning, or executing a strategy to deliver new services to an expanding base of customers (see Figure 1).

Figure 1 – Midsize/Small Service Provider Growth Strategy

Question – What role does growing your business through adding new services, entering new markets, or targeting new types of customers play in your business strategy?

n = 201

Source: IDC’s SP Digital Readiness Survey, 2021

As midsize/small service providers look to offer new services to market, they are equally focused on making improvements to service enablement and provisioning by targeting process efficiencies and expanding their service portfolio to drive profitable growth. As part of this effort, midsize/small service providers are in the process of upgrading their internal systems with a focus on operational functions critical to stimulate new sales such as:

◉ Billing (monetization)

◉ Customer order management

◉ Pricing models

◉ Partner enablement

IDC believes that data accuracy, the appropriate pricing models, the incorporation of analytics at every step of the service creation process, and work with critical partners (app developers, compute/storage providers, and channel partners) are all essential steps in supporting the efforts of midsize/small service providers to offer new compelling services to their customer base.

New Service Priorities

On the service portfolio side, there are a collection of offerings that midsize/small service providers will emphasize to satisfy customer demand for secure and reliable connectivity solutions. In the enterprise segment, private cellular services, cloud-based network services and managed services will be key areas of focus for midsize/small service providers.

According to IDC’s SP Digital Readiness Survey, midsize/small service providers indicated that private cellular services, network as a service, and managed services were their top three service priorities (see Figure 2).

Figure 2 – Priorities for Expanding Existing Service Portfolio

Question – Which of the following services represent priorities to expand your services portfolio? (Select all that apply.)

n = 147 customer-facing and internal services respondents

Source: IDC’s SP Digital Readiness Survey, 2021

Private Cellular Services. 48% of midsize/small service providers cited private cellular as their top service priority; they should also look to add incremental value on top of their connectivity solutions by partnering with ISVs and bundling industry-specific solutions that address requirements of companies in specific industry segments. IDC believes there is a broad partner ecosystem developing to service the needs of midsize and small enterprises, comprised of communication service providers, managed service providers, ISVs, VARs, and cloud providers.

Network as a Service. – While network as a service (NaaS) is still in its infancy, enterprises see value in the ability to quickly procure, deploy, manage, and retire networking assets. NaaS will enable customers to select the hardware and services to transform their network, which allows for faster access to new technologies with less risk to existing operations, improved management, faster refresh cycles, and the ability to scale with a few clicks.

Managed Services. Given the avalanche of new technologies that enterprises are evaluating, the complexity associated with implementing and operating these solutions will drive demand for managed services. This will particularly be the case in the midsize and small enterprise market segment and remote branch offices of larger enterprises where there is a lack of in-house technical expertise. IDC believes that these companies will prefer to transfer the cost of network ownership to experienced third parties with scale.

Source: cisco.com

0 comments:

Post a Comment