We’re all aware that user experience has become the most important KPI for today’s digital businesses. Applications are the engines that power these experiences, and if a digital interaction is sub-par, customers are unforgiving. Consider the situation of a prominent bank that recently suffered a series of downtimes on its mobile applications. Their users were not happy and rival credit unions were advertising, highlighting their level of service compared to the “mega-bank.” Churning customers due to digital blips is a NO-NO today. Organizations need visibility, context and control, so they can ensure that their customers are empowered with the best experiences possible. But true observability requires more than a “one size fits all” approach. Today’s application environments are highly specialized, built to support specific industries and business processes.

Observability tailored to fit specific use cases

Given the diversity and complexity of today’s modern apps, how can organizations fully align their technology to specific use case needs? Cisco FSO Platform brings data together from multiple domains including application, networking, infrastructure, security, cloud, sustainability, and business sources. It is an open and extensible, API-driven platform focused on OpenTelemetry and anchored on metrics, events, logs, and traces (MELT), providing AI/ML driven analytics.

The Cisco ecosystem of partners plays a key role in enabling this flexibility by creating custom observability solutions that help customers drive business outcomes with specific use cases. Let’s take a closer look at the Evolutio Fintech module, built by a key Cisco technology partner.

Evolutio Fintech gives holistic visibility to online financial transactions

Every moment matters in financial services, especially in online and point of sale transactions. Financial services organizations need to be able to see the full picture—and take action with insight.

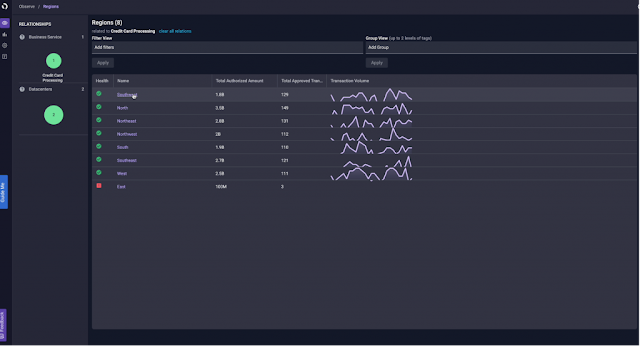

The Evolutio Fintech module correlates infrastructure health with credit card authorization data. It helps organizations reduce revenue losses resulting from credit card authorization failures by figuring out the impact of infrastructure health on the credit card authorization.

“We developed a Fintech solution for the banking sector, around credit card processing,” said, Laura Vetter, CTO and Co-Founder of Evolutio. “It looks at credit card processing, how much money is running through, and the number of transactions, split by customer region data centers, which is most relevant to the business. If someone calls in and has an issue with processing, it’s easy to look at that specific company’s data and determine whether the issue involves the whole company, or just one region.”

0 comments:

Post a Comment