For years, the album that sold the most units was Carole King’s “Tapestry”. Estimates are that this record has sold more than 25 million copies. Rife with well-known songs, an interesting comment made by one of the initial reviewers in 1971 called the song “You’ve Got a Friend” the “core” of and “essence” of the album. It didn’t hurt that James Taylor’s version also became a monster hit. For banks, they too have a friend – in their contact centers.

The malls emptied, and the contact centers filled up

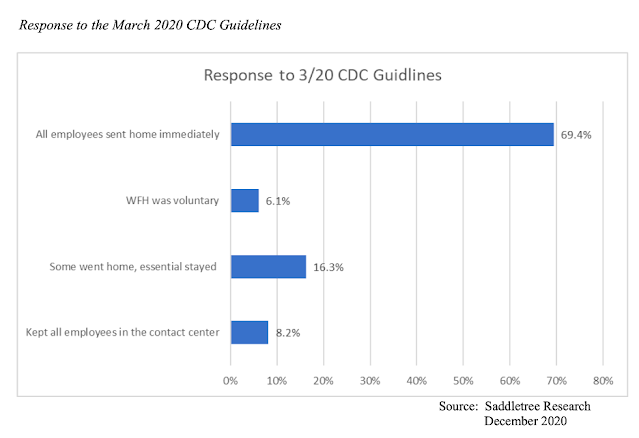

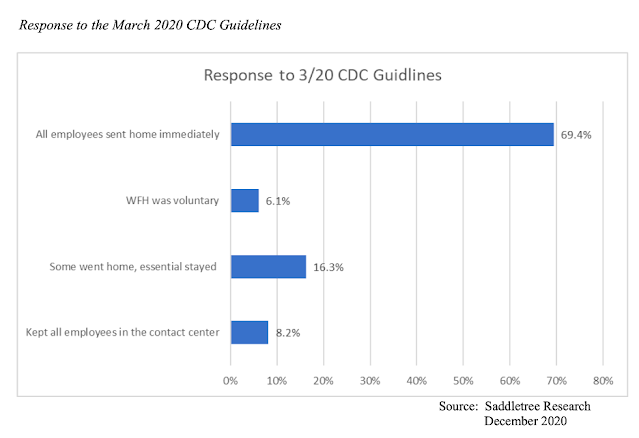

The last twelve months have initiated a renaissance in contact center operations. While the modernization of contact centers had been on a steady march, the realities of 2020 suddenly presented a giant forcing function changing the customer engagement landscape in a dramatic fashion. In one fell swoop, 36 months of planned investment in modernizing contact centers accelerated into a single 12-month period. As the physical world was shut down, the digital world ramped up dramatically. Banks saw branch visits slow to a crawl, and digital and contact center interactions increased by orders of magnitude. In addition, up to 90% of contact center agents were sent home to work, with estimates that a majority of them will stay there over time as indicated by this Saddletree Research analysis:

Prior planning prevented poor performance

Fortunately, banks and credit unions were one of the key vertical markets that were relatively prepared for 2020 and were able to lean into the challenges presented, though this was not to say things went perfectly. What was behind this preparation and what were these organizations doing prior and during the crisis? And what should they do in the years ahead?

The “Digital Pivot” paid huge dividends

At their core, banks and credit unions collect deposits and loan them out at (hopefully) a profit. With money viewed as a commodity, financial services firms were one of the first industries to understand the only two sustainable differentiators they possessed were the customer experience they delivered, and their people. It is interesting that these are the main two ingredients which comprise a contact center!

For many banks prior to 2010, the biggest challenge for contact center operations consisted of navigating mergers and acquisitions when combining operations. Normalizing operations during mergers often manifested itself in a giant IVR farms meant to absorb large amounts of voice traffic. Prior form factors for self-service were not know as “low-effort” propositions, and customer experience scores suffered for years. Banks as an aggregate industry dropped below all industry averages for customer experience, after leading for years.

The mobile revolution presented a giant reset for banking customer experience. Financial institutions by and large have done an excellent job of adopting mobile applications to the delight of their customers. In response, customer experience scores in banking have steadily risen the past 10 years, and banks are near the top quartile again, only trailing consumer electronics firms and various retailers.

Banks are more like a contact center than you think

Banks and contact centers have very common characteristics. Both wrap themselves in consumer-friendly self-service applications which automate formerly manual processes that required human assistance. These include popular customer engagement platforms such as mobile applications and ATMs. In the contact center this dynamic involves speech recognition, voice biometrics, and intelligent messaging.

As self-service has become increasingly popular, live interactions that are left over for both the branch and the contact center have become more complex, difficult to solve on the first try, and requiring collaborative, cross business resolution by the individual servicing the customer. These types of interactions are known as “outliers”. In this situation the contact center becomes in essence, a “digital backstop” where the consumer interacts with self service first and then and only then seeks live assistance.

Prior planning prevents poor performance part II

The digital tsunami started in 2010 via the mass adoption of mobile applications by banks, giving this industry in particular a significant head start on the “outlier” dynamic. Therefore in 2020 when the shopping malls emptied out and contact centers filled up, banks had already been operating tacitly in the “outlier” model for a number of years and were in a better position to succeed. Applications such as intelligent call back, integrated consumer messaging, work at home agents, voice biometrics, A.I. driven intelligent chat bots, and seamless channel shift from mobile applications to the contact center were already in place to some extent for leading financial institutions.

Thinking ahead

With much of the focus on contact center, automation in banking has been able to extend A.I. into the initial stages of customer contact. The road ahead will include wrapping A.I. driven intelligence to surround contact center resources during an interaction, essentially creating a new category of resources known as “Super Agents”. In this environment, all agents in theory can perform as the best agents because learnings from the best performers are automatically applied throughout the workforce. In addition, Intelligent Virtual Assistants, or IVAs, will act as “digital twins” for contact center agents – automatically looking for preemptive answers to customers questions, and automating both contact transcripts and after call work documentation and follow up.

Yes, if you’re a bank, you have a friend in your contact center

Banks made the pivot to delivering better customer experience in their contact centers during the “Digital Pivot” in the early 2010s. From there, banks made steady progress to reclaim their CX leadership and delivering excellent customer experiences. The realities of 2020 accelerated contact center investment by at least 36 months into a 12-month window. Banks which had established leadership utilized this forcing function to accelerate a next generation of customer differentiators, firmly entrenched in themselves as category leaders in the financial services industry. Other institutions can utilize these unique times to play rapid catch-up. Who benefits? Their customers.

Source: cisco.com

0 comments:

Post a Comment