In this post, we take on another common challenge in migrating business communications to the cloud – the increased demands on IP access connectivity – both from a technical and commercial perspective. From a technical standpoint, hosted voice and video communications are some of the most sensitive traffic to circuit quality and bandwidth limitations. From a commercial standpoint, IP access service contracts typically bring extended terms, multiple planning horizons, and a broad set of stakeholders and priorities.

The substance of this topic has led us to split the fourth installment of this series into three parts. These parts align to key steps common in IP access service procurement: 1) situation analysis; 2) requirements definition; and 3) options review and selection.

Part 1: Background and communications delivery model comparison

Part 2: Key methodologies for delivering service assurance

Part 3: Key elements in the “stack” of IP access service connectivity

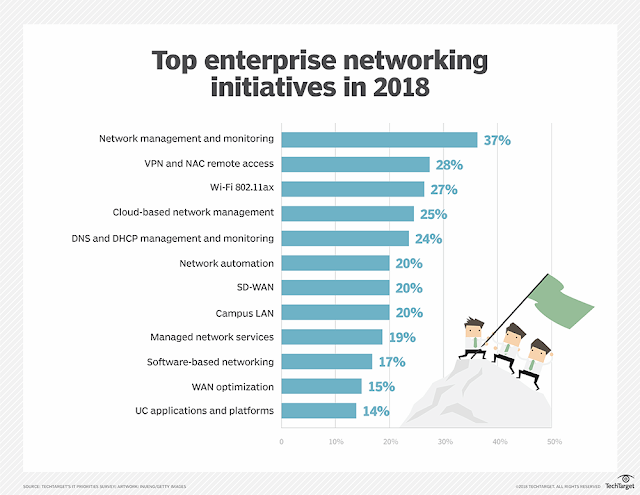

We start by looking at the breadth of challenges for IT managers and the CSPs when it comes to IP Access and WAN procurement. IT managers have a wide and growing list of priorities outside of communications. In fact, communications often sits at the bottom of the queue unless there is a problem that requires urgent attention. We see evidence of this through a review of the 2018 Tech Target Survey of IT Priorities which tracked the responses of more than 1,300 enterprise IT professionals.

The results of the survey (see figure 1 below) show an array of disparate priorities – from wireless networking and network automation to WAN optimization. Note that these priorities are tracked separately from “security,” which is covered in a separate survey question. Security cuts across all enterprise networking initiatives and typically sits at first or second overall. Back to the results shown in figure 1 – look at the position of UC applications and platforms. It actually rates at the bottom of the list at 14%. This is not surprising, especially as this equates roughly to the number of businesses at any one time that are in the midst of a communications networking project. This finding also suggests that most IT managers take a somewhat “reactive” stance to communications networking – which comes back to the entire point of this blog series – helping IT managers get ahead of communications issues by taking a more proactive and structured approach to their communications.

In addition, this survey result shows the number of competing priorities IT faces when the time comes to move communications to the cloud. They see 11 or more enterprise networking priorities, most of which are impact communications networking. Facing these obstacles, no wonder many businesses extend the operation of their PBXs five and 10 years beyond their planned end-of-life.

The substance of this topic has led us to split the fourth installment of this series into three parts. These parts align to key steps common in IP access service procurement: 1) situation analysis; 2) requirements definition; and 3) options review and selection.

Part 1: Background and communications delivery model comparison

Part 2: Key methodologies for delivering service assurance

Part 3: Key elements in the “stack” of IP access service connectivity

Background and Communications Delivery Model Comparison

We start by looking at the breadth of challenges for IT managers and the CSPs when it comes to IP Access and WAN procurement. IT managers have a wide and growing list of priorities outside of communications. In fact, communications often sits at the bottom of the queue unless there is a problem that requires urgent attention. We see evidence of this through a review of the 2018 Tech Target Survey of IT Priorities which tracked the responses of more than 1,300 enterprise IT professionals.

The results of the survey (see figure 1 below) show an array of disparate priorities – from wireless networking and network automation to WAN optimization. Note that these priorities are tracked separately from “security,” which is covered in a separate survey question. Security cuts across all enterprise networking initiatives and typically sits at first or second overall. Back to the results shown in figure 1 – look at the position of UC applications and platforms. It actually rates at the bottom of the list at 14%. This is not surprising, especially as this equates roughly to the number of businesses at any one time that are in the midst of a communications networking project. This finding also suggests that most IT managers take a somewhat “reactive” stance to communications networking – which comes back to the entire point of this blog series – helping IT managers get ahead of communications issues by taking a more proactive and structured approach to their communications.

In addition, this survey result shows the number of competing priorities IT faces when the time comes to move communications to the cloud. They see 11 or more enterprise networking priorities, most of which are impact communications networking. Facing these obstacles, no wonder many businesses extend the operation of their PBXs five and 10 years beyond their planned end-of-life.

Figure 1: Tech Target Top Enterprise Network Initiatives Survey Results for 2018

Add to this mix of priorities the available options for access IP. For IT managers evaluating connectivity, they still see a “mixed bag” of circuit types – various types of fiber, copper, and wireless services. Consider the April 2018 report from Vertical Systems Group that only 54.8% of US businesses even have access to fiber-based connectivity. Yes, this is an advance over 39.3% availability in the US in 2013. With most countries still near or below 50% fiber availability, it means that IT planners need to work with a variety of non-fiber based connectivity options. This should not halt cloud communications migrations. In fact, there are plenty of excellent non-fiber based options in the market today with new solutions on the horizon, including new 5G point-to-point technologies.

To help IT planners, we will do a round-up of common types of IP access connectivity suitable for supporting cloud communications. We will also look at service assurance mechanisms and CSP managed services typically delivered as part of network connectivity. We will outline how these mechanisms and managed services support QoS and can help IT managers move forward with confidence.

PBX-Based Communications

In a PBX-based communications architecture, the PBX or private branch exchange is typically located at the businesses site location. The PBX serves as a local registration point for communications devices and manages inbound and outbound communications traffic. The PBX together with the site’s access device enable businesses to separate their network architecture, both physically and from a management standpoint, into a “local area” and a “wide area.”

The local area network (LAN) is often managed by the business’s site IT team or can be outsourced to a 3rd party IT firm. The LAN typically serves applications that vary from business systems (ERP, CRM), security systems (entry/exit, surveillance), communications (voice, video, paging), and IT device management (printers, copiers).

If the business still operates a TDM PBX or analog lines, then the LAN may represent multiple local networks – one dedicated physical plant for voice traffic and a separate network for the broader set of IT applications.

For calls and communications that originate or terminate outside the business’s site, the calls need an outside connection. Businesses typically procure access connectivity from their communications service provider (CSP). For larger businesses that might need to manage site-to-site services, the business would procure wide area network (WAN) services from their CSP to provide PSTN access, internet access, and specialized connectivity (e.g., private lines) across sites.

As the PBX came to dominate the business communications landscape, the importance of this distinction between LAN and WAN grew. The interconnect point between the LAN and WAN became known as a “demarcation” point which represented the physical, logical, and contractual hand-off point between CSP-managed WAN traffic and IT-managed LAN traffic. In the case of PSTN services, the CSP provides voice “trunking” which might be sold a set of simultaneous call paths, minutes of use (MOU), and regulatory services such as 911.

Figure 2. Common PBX deployment with Site 1 operating a TDM PBX and Site 2 an IP PBX

Cloud-Based Communications

In a cloud communications solution, PBX functionality such as device registration, call processing, and media mixing are moved into the cloud and delivered by the CSP. The preferred way to deliver cloud-based communications is through voice-over-IP protocols and requires an end-to-end IP connection between CSP systems and user endpoints, including handsets, soft clients, conference room video systems, and more. With the call processing moving to the cloud, the nature of the LAN to WAN boundary changes. Now, the CSP directly manages endpoints and services that sit within the customer’s LAN.

This seemingly subtle change in how cloud communications services are delivered creates a significant shake-up in telecom and communications services procurement – breaking the long-established demarcation point between CSP and IT department service responsibilities. Ideally, the CSP owns “end-to-end” responsibility for the service. In reality, the IT department owns some measure of responsibility given that LAN management is outside the control of the CSP.

This shake-up in responsibilities is compounded by the opportunities to consolidate more and more services and applications in the cloud and on IP networks. WAN links will carry a lot more traffic when ERP, CRM, HR, and other apps move to the cloud. And where a business might have procured a combination of IP access, TDM, and analog circuits for resilience and legacy application needs, businesses are increasingly able to procure a single, high-quality fiber-based IP connection that can handle all or most applications requirements. While more efficient and cost-effective, this “shared services” environment also sets the stage for more questions around CSP vs. IT responsibilities for issue-resolution, SLAs, and performance optimization.

To help CSPs and IT departments address these challenges, we return to the overall theme of this blog series – reducing migration risk, building a working partnership between CSP and IT departments, and taking a more staged and structured migration approach.

To these ends, one of the areas where CSPs and IT managers need to partner is in the assessment of access network connectivity options available for each site. A business’s preferred CSP for hosted voice services may not offer bundled access connectivity with service assurance at any or most of the sites targeted for migration. In some cases, the CSP may partner with 3rd party access connectivity providers who offer access solutions with service assurance options for communications traffic. In other cases, the only option will be to carry media traffic “over the top” (OTT) on unmanaged IP connectivity.

IT managers should understand the key characteristics of access network connectivity and how these characteristics impact communications application performance. These characteristics can be broken into two areas:

◈ Layer 1 and 2 connectivity type

◈ Network services to support access layer service quality

Figure 3. Common Hosted UC Deployment Supporting Services Across Site 1, Site 2, and Mobile Users

Hello Dear,

ReplyDeleteYou have shared a beneficial blog. WAN Management making the most out of is a group of technologies and it is used to make greater doing work well of data-transfer across the Wan.

Benefits:

1. Quicker file accessibility.

2. Enables mobile workers and remote locations.

3. Improved performance.

4. More reliable and faster data recovery.

5. Increased efficiency.

6. Cost savings.

WAN optimization products are flooding the market, and choosing one can be tricky. Wanos Networks brings wan optimization solutions that offer 80% or more of the premium benefits at 20% or less of the typical wan optimization vendor cost.

Thanks & Regards,

Thomas Ashwin